Why “all-in-one” Advantage plans often don’t deliver the care patients expect & cost more in the long run.

When it comes to Medicare, the choices can feel overwhelming. Many patients hear the appealing commercials for Medicare Advantage (“all-in-one” plans) and assume they’re getting more coverage at a lower cost. But the truth is, Advantage plans and Traditional Medicare plus a Supplement are not the same. The fine print can mean the difference between affordable, timely care and months of delays, denials, and unexpected bills. In this post, we’ll break down the reality behind the marketing so you can make an informed choice.

The Appeal of Medicare Advantage

Medicare Advantage (also called “Part C”) is sold by private insurance companies. On the surface, these plans sound convenient: one card, bundled benefits, and sometimes perks like gym memberships or dental coverage.

But behind the marketing are serious limitations that many patients don’t discover until they need care. Advantage plans often come with:

- Limited provider networks, only certain doctors or specialists are covered.

- Upfront copays for emergency room or urgent care visits.

- Higher costs for advanced testing like MRIs or outpatient procedures.

- Strict referral and pre-authorization requirements (causing lapses in care due to long wait times and denials)

- High out-of-pocket costs, averaging thousands of dollars each year

In short: the insurance company, not you and your doctor, controls your care.

The Cost Misconception – A Real World Example

Medicare Advantage plans are often marketed as more affordable because they come with lower monthly premiums. On the surface, that sounds appealing, who wouldn’t want to save $100–$150 per month? However, what patients don’t always realize is while they’re saving on their monthly premium they’re actually spending more with out of pocket fees. Causing those “savings” to disappear quickly when you have multiple conditions. Patients with chronic conditions, like diabetes, quickly run into:

- High copays for hospital stays, specialist visits, or infusion drugs.

- Strict preauthorization requirements that delay or deny necessary treatments.

- Narrow provider networks that limit which doctors you can see, often forcing you to switch providers or travel farther for care.

- Out-of-pocket maximums that can reach as high as $9,350, costs you’re unlikely to face under Traditional Medicare with a Supplement.

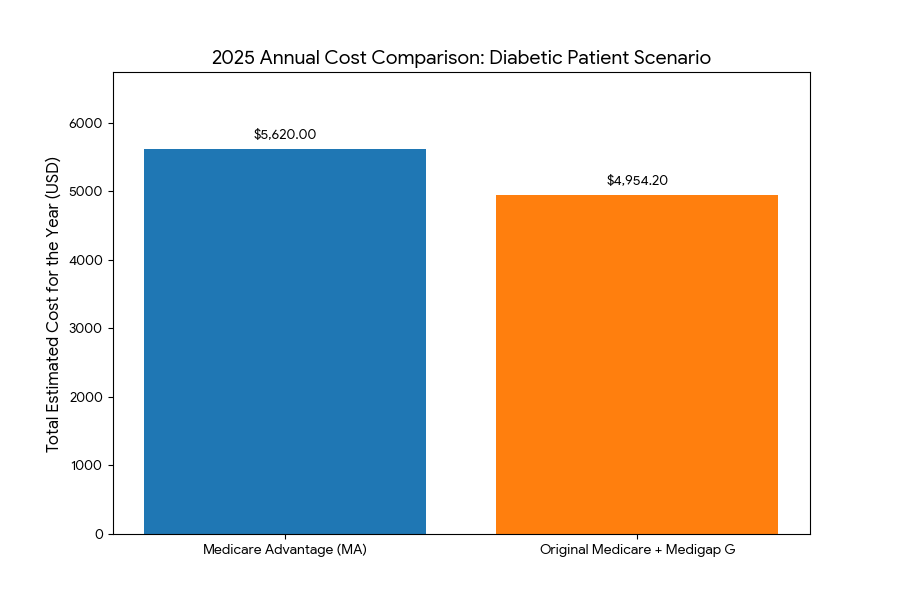

To show how this plays out, let’s look at a common scenario. A 69 year old diabetic female patient, with no other conditions, who experiences a foot ulcer incident during the year, requiring specialist visits, wound care, and possibly hospitalization.

Even though Medicare Advantage advertised itself as the “cheaper” option, in this typical diabetic patient case, the total annual cost ends up being more expensive. And that’s not even accounting for the extra hurdles, preapprovals, limited provider access, travel and potential delays in care, this patient would have experienced.

See the detailed cost analysis here breaking estimated costs for 2025 down between Medicare Advantage and Medicare + Medigap G coverage.

The Strength of Traditional Medicare + a Supplement

With Traditional Medicare (Parts A & B), you’re covered for hospital and medical services nationwide. Adding a Medigap supplement fills in the gaps, covering costs that Medicare doesn’t, such as deductibles, coinsurance, and copays.

Key advantages include:

- Freedom to choose your doctor. Any provider who accepts Medicare, no network restrictions.

- No referrals required to see specialists.

- No hidden costs. Lab fees, pre-authorizations, and other roadblocks are eliminated.

- Predictable expenses. Your supplement picks up costs Medicare doesn’t cover.

- Portability. Coverage travels with you across the country.

For most patients, this means peace of mind, predictable care, and no unpleasant surprises.

Why This Matters for Wound Care Patients

For patients managing chronic or complex conditions, such as non-healing wounds, having unrestricted access to specialists and advanced treatments is critical. Advantage plans may delay or limit these services, while Traditional Medicare with a Supplement ensures the doctor of your choice can provide the care you need without red tape.

As the saying goes, if it sounds too good to be true, it probably is. Medicare Advantage plans are designed to save money for insurance companies, and are often advertised as being in the patient’s interest which can be misleading.

Traditional Medicare with a Supplement puts you and your doctor in control. You gain freedom, flexibility, and the security of knowing your healthcare decisions are based on medical needs, not insurance company profits.

Have questions about Medicare choices and how they affect wound care? Our team at Advanced Mobile Wound Care is here to help patients and families navigate these important decisions. Contact us today to learn more about your options.